什麼是最終指南 適合初學者的房地產投資嗎? 您是否想過是否存在超越傳統投資的財務成長關鍵?

想要一些有形的、充滿活力的、具有改變潛力的東西嗎?那就進入房地產投資的世界吧——在這裡,磚塊和灰泥不僅可以建造建築物,還能鋪設通往財務繁榮的道路。

在本文中,我們將帶您了解房地產投資的基礎知識,探索其細微差別並回答可能引起您好奇的問題。

目錄:

什麼是房地產投資?

房地產投資涉及策略性購買、所有權和 管理 持有房產,旨在創造收入或實現資本增值。它超越了資產所有權的範疇,提供了一種多層次的方法來釋放資產的長期價值。

房地產投資的核心是將財務資源有目的地投入房地產的收購、改善或開發中,最終目的是為了獲得利潤。

房地產投資新手策略多種多樣,從長期租賃到快速房地產轉讓,讓投資者能夠輕鬆應對 市場走向,利用資產價格上漲,並利用租金收入取得財務收益。

將房地產視為投資

房地產之所以成為一種頗具吸引力的投資選擇,原因如下:它作為實體資產,具有穩定性和可追溯性,具有長期升值的潛力,並且有機會透過租金獲得穩定收入。

房地產可以增加投資組合的多元化,起到對沖通貨膨脹的作用,並提供稅收優惠。投資者可以掌控自己的房產,各種投資策略可以滿足不同的風險偏好。

此外,房地產可以作為遺產,提供財富轉移的機會。無論市場行情如何,只要經過仔細研究並符合個人財務目標,策略性房地產投資就能帶來正面的回報。

房地產投資初學者策略

最適合房地產投資新手的策略是什麼?每種策略都有其自身的考量因素,成功取決於透徹的研究、對市場的理解以及與自身財務目標的契合。在做出重大房地產投資決策之前,請務必諮詢專業人士並進行盡職調查。

買入並持有

- 策略:長期投資房地產,將其出租以獲得穩定的收入來源。

- 分析:此策略利用房產升值和租金產生的穩定收入,使其成為長期財富累積的保守選擇。

- 例如:在一個不斷發展的社區購買一套複式公寓,出租一套,自己住在另一套,同時房產價值會隨著時間的推移而增加。

最適合:穩定的租金收入、潛在的房產升值和稅收優惠。

修復和翻轉

- 策略:購買不良資產,進行翻新,然後快速出售以獲取利潤。

- 分析:此策略需要積極參與房地產修復和市場時機把握,目標是以可觀的利潤率出售。

- 例如:購買一處止贖房產,投資裝修,然後在市場反彈後以盈利的方式出售。

最適合:快速獲得回報的潛力以及物業裝修方面的技能發展。

房地產投資信託(REIT)

- 策略:投資公開交易的房地產投資信託基金 (REIT),以獲得多元化的房地產投資組合。

- 分析:提供具有流動性的被動房地產投資,適合想要避免物業管理的投資者。

- 例如:投資專注於醫療保健房地產的房地產投資信託基金,以從醫療保健房地產行業的穩定性中獲益。

最適合: 多樣化、流動性和最少的實際參與。

批發

- 策略:以較低的價格獲得房產,並收取費用將合約轉讓給另一個買家。

- 分析:需要強大的談判技巧和敏銳的洞察力,能夠發現被低估的房產。所需資金較少,但需要高效率的交易管道。

- 例如:確定不良資產,協商有利的交易,並將合約轉讓給尋求修復和翻轉機會的房地產投資者。

最適合:前期資本低,注重交易尋找技巧。

房地產眾籌

- 策略:透過網路平台,聯合其他機構共同投資房地產專案。

- 分析:降低進入門檻,以較少的投資獲得較大的項目。

- 範例:投資一個眾籌平台,支持高需求城市地區的住宅開發案。

最適合:降低個人風險,投資機會多樣化。

房屋黑客

- 策略:住在多單元房產中的一個單元中,並將其他單元出租以支付抵押貸款成本。

- 分析:提供了一個獨特的機會,可以減少個人生活開支,同時透過財產所有權建立資產淨值。

- 例如:購買一套四單元住宅,自己住一套,出租另外三套以支付抵押貸款和生活費用。

最適合: 產生租金收入和第一手的物業管理經驗。

REO(自有房地產)投資

- 策略:向銀行或貸款機構收購法拍後的房產。

- 分析:涉及以潛在較低的成本購買不良資產,但需要仔細的盡職調查。

- 例如:參加法拍拍賣並以低於市場價值的價格收購銀行擁有的財產。

最適合:有可能以低於市場價值的價格收購房產,並有機會獲得價值升值。

租賃選項

- 策略:為租戶提供在指定租賃期後購買房產的選擇。

- 分析:將租金收入與潛在的未來房產銷售結合起來,為雙方提供靈活性。

- 例如:將房產出租給租戶,並允許他們在三年內選擇購買,讓他們有時間獲得融資,同時獲得租金收入。

最適合:吸引潛在買家,並提供持續的租金收入。

關鍵要點

簡而言之,房地產投資為初學者提供了一條超越傳統投資的財務成長之路。房地產不僅僅是一筆交易,它代表著通往長期財務成功的旅程。憑藉豐富的知識,初學者可以開啟通往這個行業的大門,在這個行業中,房地產的實際變革潛力將成為長期繁榮的基礎。

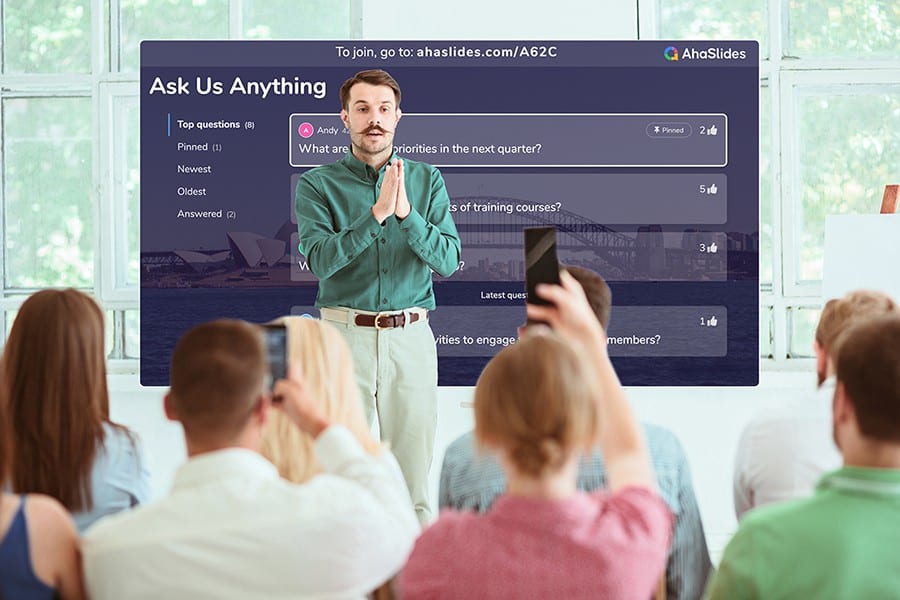

💡 正在為新手製作房地產投資研討會,卻無法吸引顧客?無論是商業演示還是個人演示,AhaSlides 都能幫您解決所有問題。前往 啊哈幻燈片 解鎖新功能 人工智慧幻燈片生成器 免費!

常見問題(FAQ)

我可以投資 100 美元購買房地產嗎?

只需100美元,您就可以透過房地產投資信託基金(REIT)或眾籌平台等途徑進入房地產領域。這些選擇讓您無需大量的前期投入即可投資房地產項目。

投資哪種房地產最賺錢?

房地產的獲利能力取決於地理位置和房產類型等因素。住宅物業和租賃單位通常被認為利潤豐厚。尋找需求高且房產升值潛力大的地區,以獲得最佳獲利能力。

哪種類型的房地產回報率最高?

為了獲得穩定的回報,住宅或公寓等租賃物業很受歡迎。然而,最佳回報取決於地理位置、市場趨勢和您的投資目標等因素。

哪個房地產的投資報酬率 (ROI) 最高?

實現最高投資回報率 (ROI) 的方法各不相同,但一些投資者透過房屋翻新等策略獲得了成功,從而快速獲利。熱門地區的商業房地產也能帶來高回報,儘管這通常需要更大的初始投資和更複雜的管理。

參考: 財富締造者